Arcadian Risk Capital Announces Entry into Management Liability (“ML”) with the Hire of Mark Butler

Arcadian announces the appointment of Mark Butler as Executive Vice President to lead the Company’s expansion into the U.S. Management Liability (“ML”) market. In connection with the appointment, Arcadian has secured Lloyd’s coverholder status and multi-year capacity to support the expansion.

Arcadian Risk Capital Announces Investment from Lee Equity Partners

Lee Equity’s investment will accelerate Arcadian’s continued expansion into new lines of business and geographies. The Company is actively targeting experienced underwriting teams with proven track records underwriting across insurance cycles.

SiriusPoint-backed MGA Arcadian Risk Capital sets sights on significant growth following extension of partnership

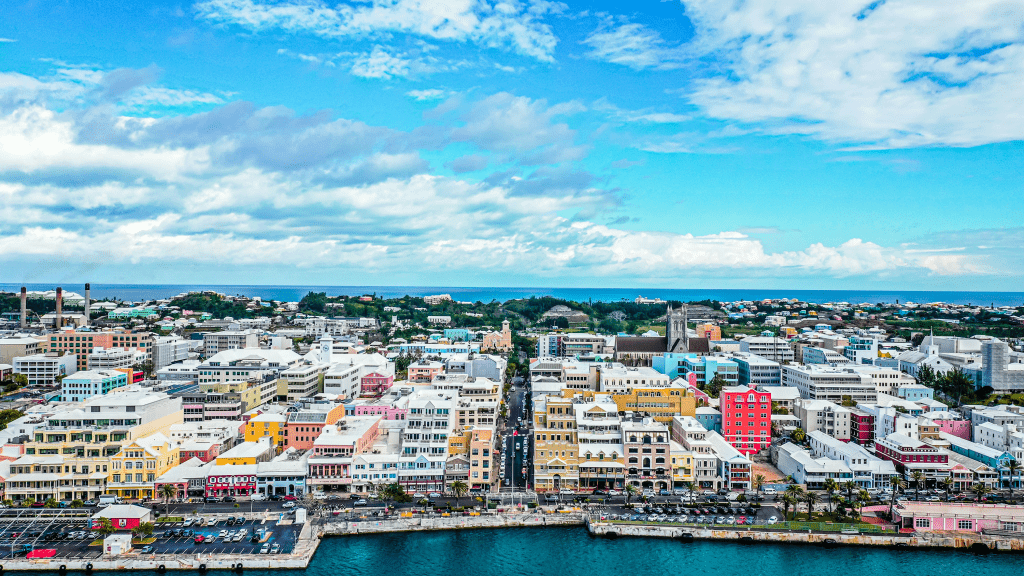

SiriusPoint Ltd. (“SiriusPoint” or the “Company”) (NYSE: SPNT), a global specialty insurer and reinsurer, and Arcadian Risk Capital Ltd. (Arcadian), a Bermuda-based Managing General Agent (MGA), have announced the extension of their multi-year partnership through 2026.

Arcadian Risk Capital (UK) Ltd. enters into a D&F property binding arrangement with Aviva Insurance Limited UK.

The multi-year agreement will support and enhance the MGA’s short tail book of technically engineered, risk management business, written either as a direct insurance or facultative reinsurance placement. The account is underwritten from its London desk by seasoned market underwriter, Barry Marren.

Arcadian announces GWP of $225 million in first year of underwriting results

The company, which is led by John Boylan, a well-known industry executive with a 35 year track record in the global insurance market, received approval from the Bermuda Monetary Authority in August 2020 and opened its Bermuda office in October 2020.